Sales And Services Tax

Retail services are services subject to sales tax. In order for sales of services to qualify for exemption as casual sales the sale must be made by a person who is not a retailer.

Sales And Service Tax Sst Implementation Effective 1 August 2019

Sst Malaysia Malaysia Has Re Introduced The Sales By Company Registration Expert Medium

Wkisea Sales And Services Tax Sst Mechanism

If you know your account number you can request your forms online through our INBiz system by clicking the Order Coupons link.

Sales and services tax. Services that qualify as casual sales are exempt from sales tax. While she wont collect sales tax on the repair service she will be required to collect sales tax on the components she sells. A GST perspective In the run-up to Budget 2018 our Head of Indirect Tax Raja Kumaran discusses the need for a more resilient and sustainable GST system in Malaysia.

As announced in recent March Tax Alerts by Maine Revenue Services MRS the deadline for Maine sales tax filing and payment is unchanged. Contractors cannot purchase such services tax-free for resale from a third party. The listing also includes some examples and links to additional resources.

If you would like to learn more or allow us to work hard to make your life easier click here. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a. See PS 20042 Sales and Use Taxes on Access to the Internet and Other On-line Sales of Goods and Services and PS 20068 Sales and Use Taxes on Computer-Related Services and Sales of Tangible Personal Property and SN 20155 2015 Legislative Changes to the Sales and Use Taxes Rental Surcharge Dry Cleaning Surcharge and Admissions Tax for more details note that these.

The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so. Any sales form not listed here is considered a Controlled Document meaning it must be preprinted for the user with a pre-established account number. Juanita is opening a computer store where shell sell components parts and offer repair services.

This service is not considered contractor labor for sales tax purposes. For more information on the taxation of computer services please review Policy Statement 20068 Sales and Use Taxes on Computer-Related Services and Sales of Tangible Personal Property. This is because unlike income tax revenues sales tax is a trust fund tax that is collected by retailers from customers in trustfor the State.

Or if the seller is a retailer the current sale must be unrelated to the retailers regular business and must not involve a liquidation of the business. Below is a listing of service categories that are subject to sales tax when provided to consumers. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

If you have more questions about sales tax you may call our sales tax information line at 317 232-2240. California Sales and Use Tax Regulation 1524b1B Sales and use tax law is often assumed to be relatively simple and straightforward. Cscohiogov Tax Rates Only.

Nor can such services be purchased tax-free under a Purchasing Agent Appointment Form 17 issued by the governmental unit or exempt entity. OIT Service Desk 614-644-6860 or 877-644-6860 or -- email. The Finder is a service offered by the Office of Information Technology OITDepartment of Administrative Services.

Include your account number tax type start date and end date for the periods needed. Some cities in Colorado are in process signing up with the SUTS program. Use tax applies to purchases of tangible personal property products transferred electronically and certain services when sales tax is due but is not collected by the seller.

The sales and use tax rate for the sale of computer and data processing services is 1. Dan Davis CPA CFE is a partner with Associated Sales Tax Consultants in Sacramento. Most states charge sales tax on most products sold in the state but sales taxes on services vary widely.

As you can see that assumption may be hazardous to your financial health. Some of our core services include sales tax return filing exemption certificate management registrations of all types business licensing nexus services for both income and sales tax consulting research audit defense and like our name states more. Prescription drugs are exempt from sales taxes in almost every state while most states charge sales tax on non-prescription drugs and Illinois levies a 1 tax on non-prescription drugs.

If you have questions or concerns about information listed on The Finder please contact. This exception applies only to businesses with less than 100000 in retail salesBeginning February 1 2022 all retailers will be required to apply the. Welcome to the Sales and Use Tax Simplification SUTS Lookup Tool.

Sales Tax Return Instructions PDF July 2020 current form ST-7 Sales Tax Return Instructions PDF January through June 2020 ST-7 Sales Tax Return Instructions PDF February 2019 to December 2019 ST-7 Sales Tax Return Instructions PDF February 2018 to January 2019 ST-7 Sales Tax. Construction services WAC 458-20-170 Constructing and improving new or existing buildings and structures. Taxable Services Maryland law states that a charge for the following services is subject to sales and use tax1 Fabrication printing or production of tangible personal property by special order.

Governor Polis signed SB21-282 on June 30 2021 which extends the small business exception to destination sourcing requirements. ODT Taxpayer Services 1-888-405-4039 or -- email. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

This site is now available for your review. Reducing the cost of doing business. Charges for services are generally exempt from Maryland sales and use tax unless they are specifically taxable under Maryland law.

If you purchase an item for use in Utah from an out-of-state retailer or on the internet and the retailer or internet seller does not collect the sales tax then you must pay use tax on the item directly to the Tax. Cities that have not yet signed up will be shown with a red exclamation mark beside their sales tax rate.

Sales And Service Tax Sst Archives E Spin Group

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Goods And Services Tax Gst The Importance Of Comprehension Towards Achieving The Desired Awareness Among Malaysian Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For

Sales And Service Tax Needs A Review In The 2019 Budget Marketing Magazine Asia

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Is Not New The Concept Behind Gst Was Invented By A French Tax Official In The 1950s In Some Countries It Is Known As Vat Or Value Added Tax Today More Than 160 Nations Including The European Union And Asian Countries Such As Sri Lanka

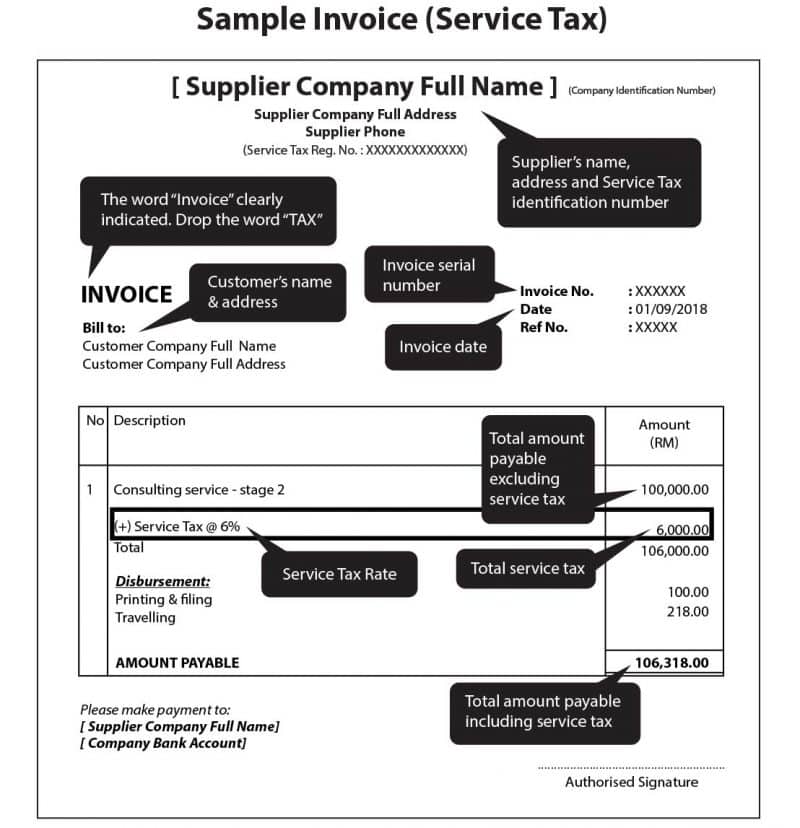

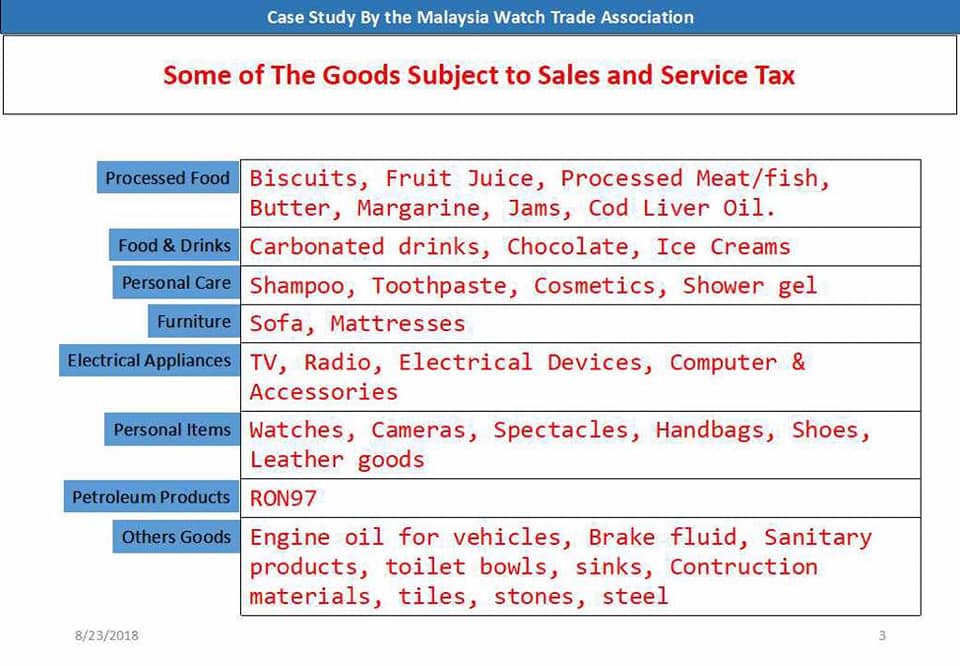

Malaysia Sales And Services Tax Sst Mwta

You have just read the article entitled Sales And Services Tax. You can also bookmark this page with the URL : https://cristianctz.blogspot.com/2022/02/sales-and-services-tax.html

0 Response to "Sales And Services Tax"

Post a Comment